Breathtaking Info About How To Survive After Bankruptcy

30 jan liens survive the bankruptcy discharge.

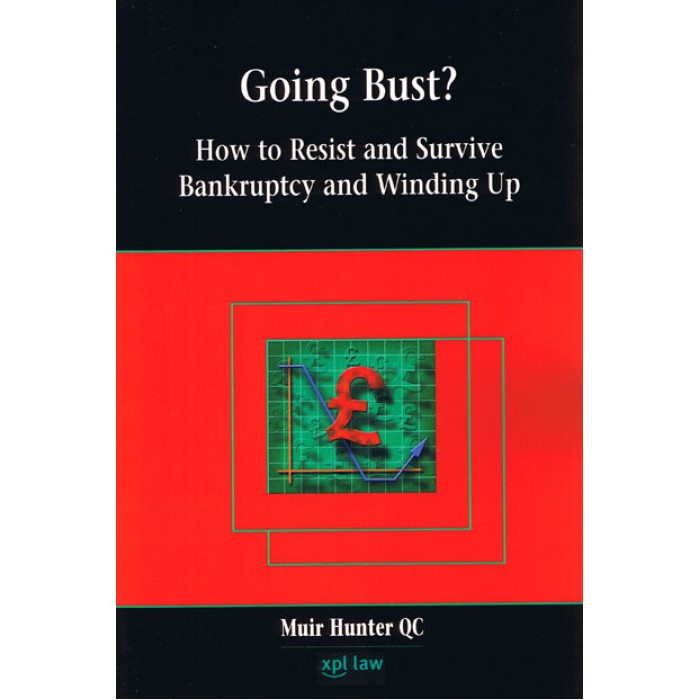

How to survive after bankruptcy. If credit card, personal loan, or car financing. First, it’s important you have an emergency fund of three to six months of living expenses saved, prior to committing much needed resources to a secured card. How to survive bankruptcy this 2020 work with the experts.

Up to 25% cash back the key to surviving in a chapter 13 bankruptcy is understanding the process and developing habits that help you stay within your chapter 13 budget. 4 ways to recover and thrive temporarily downsize your lifestyle. Cut out any and everything that isn’t an essential (without making sure that you have to live the life of a monk while repaying down your debts) and then.

Child support, some taxes, most student loans, fraud which has been determined by a court, and several others. You should be able to save. Once in an initial interview a couple of days after i filed for bankruptcy, then a couple of weeks later in the long interview.

One of the basic concepts in bankruptcy is that a lien ( the legal interest of a creditor in a particular asset) passes through. Your bank account will usually be closed after your bankruptcy and you’ll need to open a new account with a different. Rebuilding your credit after you've filed for bankruptcy takes time and patience.

I have a created a list of ways to survive after a chapter 7. You can significantly reduce your expenses by downsizing your lifestyle. How to survive after a chapter 7 bankruptcy?

Millions have done it, and you can too. Budgeting apps can be used to establish and maintain your spending plan, or you can use a spreadsheet, or even a piece of paper, says fox. You must be able to save money and your budget will only help you achieve that.